chfa timeline

Since 1974, CHFA has had the privilege to collaborate with valuable partners, innovators, and changemakers to build stronger communities through investments to support homeownership, business growth, affordable rental housing development, and mission-aligned nonprofits.

1973

1973-1974

CHFA is created and begins operations

To address the shortage of affordable housing in the state, the Colorado General Assembly passes enabling legislation, setting bonding authority, and providing seed money to create CHFA. Our original Board of Directors and Executive Director, Walter Kane, were appointed in 1974.

Pictured: CHFA's original Board of Directors

Pictured below: Walter Kane, Executive Director, 1974 to 1976; Copy of CHFA’s original statute

1974

1975

1975

CHFA launches homeownership programs

CHFA issues $28 million in bonds and launches its Loans-to-Lenders home purchase program, which saw great success. It followed with the Single Family Mortgage Purchase program launched in 1978, which enabled CHFA to act as a “secondary market” by purchasing home mortgages provided by participating lenders to low- and moderate-income buyers.

Pictured: A single family home in Colorado

1976

1976

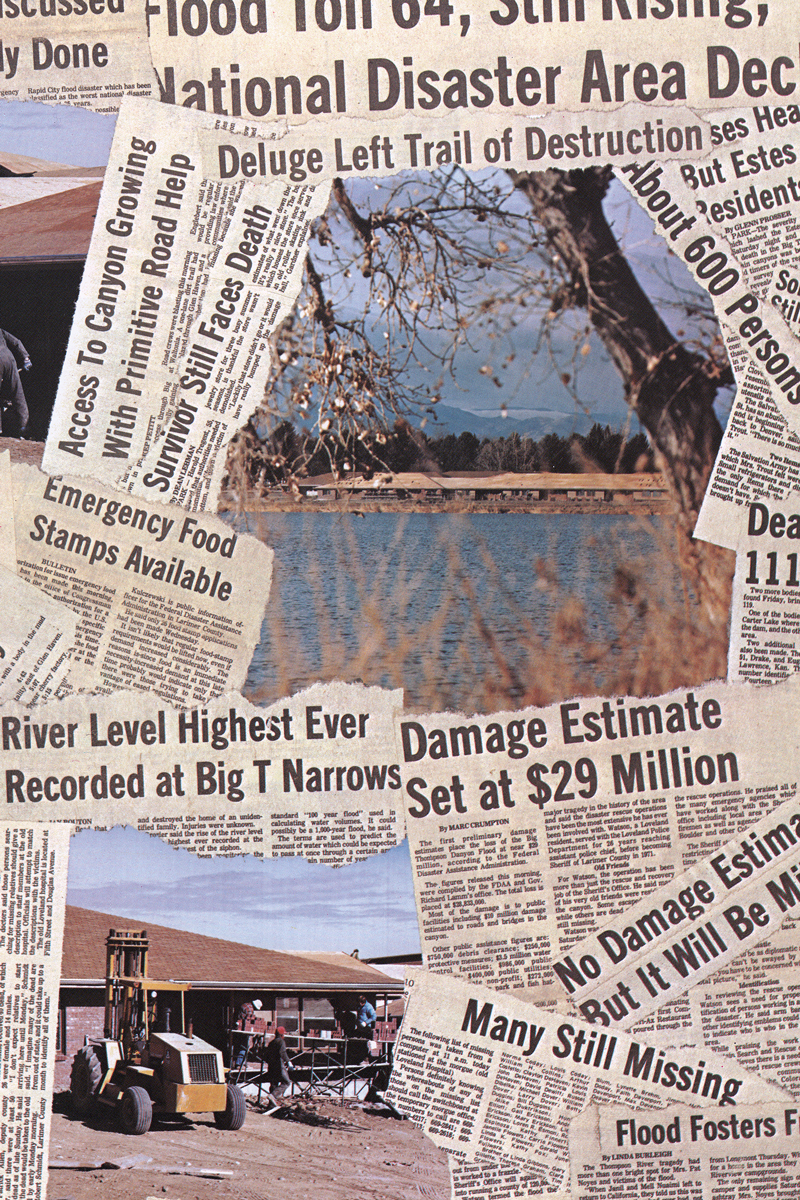

Housing built following Big Thompson flood

Many are left homeless following the Big Thompson flood, which takes the lives of more than 140 people. CHFA partners with the Loveland Housing Authority and Colorado Division of Housing to support Silverleaf II, a 72-unit affordable rental housing development serving displaced seniors.

Pictured: Silverleaf II

1977

1977

David W. Herlinger becomes Executive Director

Dave Herlinger is appointed Executive Director by CHFA’s Board of Directors following the resignation of Walter Kane. He leads CHFA for the next 23 years, becoming CHFA’s longest-serving Executive Director, and leaves an indelible legacy.

Pictured: David W. Herlinger, Executive Director, 1977 to 2000

1982

1982

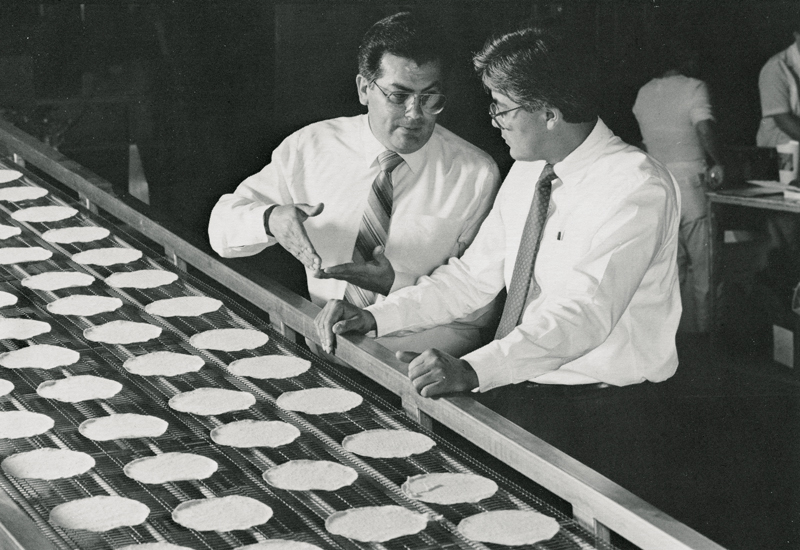

CHFA begins small business finance

During a difficult economic environment, the Colorado General Assembly expands CHFA's mission to include economic development. Business finance becomes a permanent expansion of CHFA’s mission.

Pictured: Candy's Tortillas, CHFA business finance customer, Pueblo

1987

1987

Low Income Housing Tax Credit is created

Under President Reagan’s administration, the federal Low Income Housing Tax Credit (LIHTC) is created in 1986 and CHFA begins administering the program in 1987. LIHTC becomes the most significant resource for the development or preservation of affordable rental housing.

Asset Management Division formed

CHFA creates an Asset Management Division to oversee its multifamily housing and business finance portfolios. The division offers compliance oversight, educational expertise, and customer service for multifamily property owners, managers, staff, and residents.

Pictured: Resident at Silvercliffs, CHFA rental housing customer, Silver Cliff

1988

1988

Rental Acquisition Program launched

Designed to help Colorado’s depressed economy and soft housing market, CHFA launches its Rental Acquisition Program (RAP). CHFA purchases and renovates existing apartment buildings at low costs through RAP, and keeps rents affordable to low income families without federal subsidies.

Pictured: Maple Tree Apartments, former CHFA RAP property, Denver

1988

CHFA Mortgage Credit Certificate program begins

A popular program with borrowers and lenders, CHFA’s Mortgage Credit Certificate (CHFA MCC) is launched. The CHFA MCC allows borrowers to reduce the amount of federal taxes owed by claiming 20 percent of their annual mortgage interest as a tax credit on their return.

Pictured: The Arevalo family, CHFA homeownership customers, Greeley

1989

1989

CHFA moves to Blake Street

CHFA purchases a building at 1981 Blake Street in downtown Denver to meet its growing needs. The area is in great need of renewal, and CHFA’s arrival gives the neighborhood a stable anchor. Soon after, the community begins to change as more businesses move to the area.

CHFA headquarters, Denver

1990

1990

CHFA creates Housing Opportunities Fund

CHFA’s Housing Opportunities Fund (HOF) is established to support affordable housing by providing a flexible source of funding. HOF has addressed unique homeownership and affordable rental housing needs since its inception.

Pictured: The Mielkus family, CHFA homeownership customers, Thornton

1991

1991

Down Payment Assistance launches

CHFA starts a Down Payment Assistance (DPA) pilot program to help first time homebuyers pay for down payment and closing costs. DPA becomes a flagship CHFA Home Finance product and continues to provide housing stability for Coloradans.

Pictured: The front porch of a single family home

CHFA assisted me in homeownership by equipping me with the knowledge and education necessary when making such a huge decision and commitment. The down payment assistance made it less stressful and provided more assurance in the initial loan process.

1998

1998

CHFA begins Homebuyer Education

CHFA starts requiring homebuyer counseling and education for each borrower prior to their loan closing. The following year, CHFA develops a complete homebuyer education program, providing a consistent curriculum for housing counselors across the state.

Pictured: CHFA homebuyer education class participants

2001

2001

Roy Alexander becomes Executive Director and CEO

Following the retirement of Dave Herlinger, CHFA’s Board of Directors appoints Roy Alexander as Executive Director and CEO.

Pictured: Milroy Alexander, Executive Director, 2001 to 2009

2002

2002

CHFA SectionEight Homeownership begins

CHFA makes history as the first state housing finance agency in the nation to allow individuals to use their Section 8 voucher toward homeownership. This innovation begins with CHFA HomeAccesssm, a program to help people with disabilities achieve homeownership, then expands to all borrowers through the CHFA SectionEightsm Homeownership program.

Pictured: Christine McDonald and family, CHFA homeownership customer, Boulder

2003

2003

$50 million Economic Development Initiative created

CHFA launches a $50 million Economic Development Initiative to support business finance. This partnership with the Colorado Office of Economic Development and International Trade focuses on manufacturing facilities, small businesses, ranchers, farmers, nonprofits, women- and minority-owned businesses, and expanding existing programs.

Pictured: Florence Square, mixed-use development supported by Economic Development Initiative, Aurora

2004

2004

Annual golf tournament founded

CHFA begins hosting an annual golf tournament to raise funds for local nonprofit organizations whose missions support affordable housing and economic development. The tournament becomes named after Dave Herlinger following his passing in 2012, and by 2014, surpasses $1 million raised for local nonprofits since its inception.

Pictured: 2013 David W. Herlinger Golf Tournament

2005

2005

CHFA helps Hurricane Katrina victims

Hurricane Katrina displaces many Gulf State residents, and thousands land in Colorado. CHFA provides 50 vacant CHFA-owned apartments rent-free to evacuees. CHFA also helps launch ColoradoHousingSearch.com, a directory of affordable rental and for-sale homes—proving highly valuable in the weeks and months following Hurricanes Katrina and Rita.

Colorado Growth and Revitalization Fund begins

In a partnership with the City and County of Denver and the Colorado Enterprise Fund, CHFA applies for and receives an allocation of $40 million in New Markets Tax Credits to launch the Colorado Growth and Revitalization (CGR) Fund. The CGR Fund generates private sector economic development in underserved neighborhoods.

Pictured: Curtis Miller, Hurriance Katrina evacuee and resident of Village of Yorkshire, CHFA rental housing customer, Thornton

The loan from CHFA enabled us to purchase our office space and be in control of our own destiny,” said Angela. Katie added, "Our CHFA Rural Development Loan has a reasonable payment and that has allowed us to have money to make upgrades to the property and establish our finances. This has helped us become successful and serve more clients.

2006

2006

CHFA launches chfareach

CHFA expands its industry education program by creating chfareach: Resources, Education, and Assistance for Colorado’s Housing. Chfareach education informs members and participants about the affordable housing industry, such as regulatory compliance, safety, fair housing, and tenant relations.

Pictured: chfareach training participants

2007

2007

Western Slope office opens

CHFA opens its second office in Grand Junction to better serve Western Slope customers. CHFA staff visits communities throughout western Colorado to provide training and technical assistance on all of our lines of business.

Pictured: CHFA's Western Slope office, Grand Junction

2008

2008

Foreclosure prevention programs created

CHFA partners with Brothers Redevelopment, the Colorado Division of Housing, and statewide industry leaders to sponsor the Colorado Foreclosure Hotline, a resource connecting homeowners at risk of foreclosure with free, HUD-approved housing counseling. CHFA also works with partners to secure grant funding to support the costs of providing statewide counseling at no cost to borrowers.

Pictured: A family sitting on a couch in their home

2009

2009

CHFA helps ease credit crunch

To improve financing for small businesses following the global economic meltdown, CHFA, along the Office of Economic Development and International Trade (OEDIT), works to regenerate the Colorado Credit Reserve (CCR) program. CHFA and OEDIT’s efforts result in the recapitalization of CCR with $2.5 million.

CHFA collaborates with Ginnie Mae

CHFA’s traditional source of home financing—the municipal bond market—freezes following the global economic collapse. CHFA finds an alternative to serve Coloradans by collaborating with Ginnie Mae and launches the CHFA HomeOpenersm and CHFA HomeOpener Plus loan programs.

Pictured: Ace Hardware, CHFA business finance customer, Pagosa Springs

Pictured below: Resident at Village of Westerly Creek, CHFA rental housing customer, Aurora; Molly Dubois, CHFA homeownership customer, Denver

2010

2010

Transit-oriented Development Fund launched

As Colorado rapidly expands its light rail and bus systems, CHFA collaborates with the Urban Land Conservancy who leads an effort to build affordable housing near transit. These partnerships create the Denver Transit-Oriented Development Fund, which supports hundreds of transit-oriented affordable rental homes throughout Denver.

Pictured: Evans Station Lofts, CHFA rental housing customer, Denver

2010

Cris White becomes Executive Director and CEO

CHFA’s Board of Directors appoints Cris White as Executive Director and CEO, following Roy Alexander’s retirement.

Pictured: Cris White, Executive Director and CEO, 2010 to present

2012

2012

CHFA designs new capital access programs

CHFA partners with the Colorado Office of Economic Development and International Trade to design capital access programs funded through the federal State Small Business Credit Initiative. With these funds, CHFA administers the Cash Collateral Support and the Colorado Capital Access programs which support creditworthy small businesses struggling to access loans.

Pictured: Integrated Design Solutions, LLC, CHFA business finance customer, Gunnison

CHFA has always been driven to give the best of ourselves to those we serve. This drive has laid a foundation from which we work to help all Coloradans achieve housing stability and economic prosperity—every day, every year, and always.

2014

2014

CHFA helps communities with flood recovery

Following devastating floods in 2013, CHFA begins leveraging its resources with others at federal, state, and local levels to help communities rebuild. Low Income Housing Tax Credits combined with federal disaster recovery funds are awarded to 15 developments between 2014 and 2016, to create or preserve 1,488 affordable rental housing units in flood-impacted communities.

Pictured: Falcon Ridge, under construction, CHFA rental housing customer in flood-impacted Estes Park

2014

State Affordable Housing Tax Credit (AHTC) renewed

The Colorado General Assembly renews the state LIHTC program, bolstering much needed affordable rental housing in Colorado. This enables CHFA to support nearly 3,000 units with state LIHTC between 2015 and 2016, and leverage $17.4 million in previously underutilized federal 4 percent LIHTC. This success leads to renewal of the program through 2031.

Pictured: May 29, 2014, Signing of HB-1017, renewing State LIHTC

2015

2015

Housing Preservation Network established

With the risk of approximately 22,000 affordable rental housing units’ affordability restrictions expiring over the next decade, CHFA begins a preservation initiative within its own operations, and helps form the Colorado Housing Preservation Network (HPN). The group invests $122 million to support the preservation of nearly 5,000 units in 2016.

Pictured: Residents at Hatler-May Village, CHFA rental housing customer, Colorado Springs

2016

2016

CHFA crosses the $1 billion mark

For the first time in CHFA’s history, it invests more than $1 billion in first mortgage loans in a single year. CHFA’s historic investment is a reflection of the market and need for affordable homeownership in Colorado, whose Denver metro area ranks second in the U.S. for strongest home price growth over the past 25 years.

Pictured: The Scott family, CHFA homeownership customers, Johnstown

2016

CHFA adopts a bold new vision

For 2016 and beyond, CHFA embraces a new vision: “Everyone in Colorado will have the opportunity for housing stability and economic prosperity.” This aspirational vision challenges CHFA to strengthen and expand partnerships, broaden community impact, and ensure a diverse and sustainable financial profile.

Pictured: Women's Bean Project, CHFA business finance customer, Denver

2017

2017

CHFA transforms downtown Denver headquarters

After 27 years at 1981 Blake Street, a complete renovation becomes necessary to maintain the office’s systematic integrity for its current and future workforce. CHFA takes this opportunity to incorporate modern creative and technological features throughout its new space. The renovation also allows CHFA to lease offices to local organizations, expanding the opportunity for strategic community partnerships.

Pictured: CHFA's updated Blake Street office

2018

2018

Capital Magnet Fund created

CHFA unveils a new statewide affordable rental housing fund, the Capital Magnet Fund. Established by a grant awarded to CHFA by the U.S. Department of the Treasury, the Capital Magnet Fund provides low-interest, flexible financing and grants for developers building or preserving affordable rental housing.

Pictured: Pancratia Hall Lofts, CHFA rental housing customer, Denver

We would have a lot more overcrowding and the workforce—the people who are making the community work—can't afford a one-bedroom rent without bunking up with someone else. Having this brand new, beautiful, well-done apartment complex is invaluable," said Jennifer Kermode, Executive Director of the Gunnison Valley Regional Housing Authority, which developed Anthracite Place. "Anthracite Place is a model public-private partnership. Even local citizens are pointing to it saying, 'look at this success' and asking for more projects like it in the area," said Jennifer. She adds, "I'm most proud of how this development has helped residents become more united with the community in which they work.

2019

2019

CHFA focuses on deeper engagement with communities

To learn more about unique community needs and to increase its statewide impact, CHFA expands its community relations team to reach more regions, participates in multiple engagement tours throughout the state, and strengthens partnerships through educational opportunities.

Pictured below: Staff, La Puente’s Adelante Family Resource Center, Alamosa

2019

Direct Effect Awards renewed

CHFA expands its Corporate Giving program, including reintroducing its Direct Effect Awards. Direct Effect provides immediate and direct funding through grants awarded to nonprofit organizations whose missions align with CHFA’s work to strengthen Colorado by investing in affordable housing and community development.

Pictured below: The Piñon Project Family Resource Center, Cortez

2020

2020

CHFA administers pandemic relief

As Colorado faces unprecedented challenges during the COVID-19 pandemic, CHFA leverages existing programs to help keep businesses open, and donates more than $500,000 to organizations working in direct response to the pandemic. CHFA is also selected to administer newly-created relief programs such as the Energize Colorado Gap Fund and the CLIMBER Loan Fund.

Pictured: Walsh Community Grocery Store, CHFA business finance customer, Walsh

2020

Mi Hogar

CHFA launches a Spanish-language microsite, Mi Hogar (which means “my home” in Spanish), alongside targeted outreach efforts to support prospective Spanish-speaking homebuyers across the state.

Pictured below: David and Joana with their family, CHFA homeownership customers, Greeley

2020

Black and African American homeownership engagement

A partnership begins with the African American Trade Association to help CHFA better understand the homebuying challenges that Black and African American households face and foster greater community engagement in support of homeownership opportunities.

Pictured below: Celize and E.J., CHFA homeownership customers, Colorado Springs

2021

2021

Small-scale affordable housing technical assistance

Through a pilot program, CHFA begins offering pro-bono technical assistance to advance small-scale housing development from a team of affordable housing development consultants retained by CHFA.

Pictured: 2021 Pueblo Stakeholders Meeting

PCHC’s successful New Market Tax Credit transaction validated what its Board of Directors learned and approved in its strategic plan: a substantial need for a quality health care facility for people living in the east Pueblo neighborhood,” said Donald Moore, CEO of PCHC. “In addition to ensuring access to primary care for decades to come, the tax credit financing also enables PCHC to realize its vision of building a “Net Zero” designed building. The facility will produce more energy than it consumes thereby lowering Pueblo’s greenhouse gas footprint. We are thrilled CHFA was attracted to our project and helped PCHC gain access to NMTC.

2022

2022

Middle-income Access program

As accessing affordable housing becomes increasingly challenging for households earning moderate incomes, CHFA’s Middle-income Access program is supported with $25 million in state funds. This strengthened the program’s ability to support developments serving middle-income households across the state.

Pictured: Wintergreen Apartments, CHFA rental housing customer, Keystone

2022

Voters pass Proposition 123 to fund affordable housing

Through a statewide ballot measure, Coloradans pass Proposition 123, the first permanent, dedicated statewide fund for affordable housing. CHFA is selected to serve as contract administrator for 60% of the funds by the Colorado Office of Economic Development and International Trade (OEDIT).

Pictured: www.coloradoaffordablehousingfinancingfund.com

2024

2024

State legislature advances key affordable housing investments

The Colorado General Assembly passes bills to strengthen and expand the state Affordable Housing Tax Credit (AHTC) through 2031, and to establish the Middle-income Housing Tax Credit (MIHTC) pilot program. MIHTC, a tax credit program to support the development of housing to serve residents earning middle incomes, is the first of its kind in the nation.

Pictured: Residents at Alpenglow Village, CHFA rental housing customer, Steamboat Springs