Affordable Housing for Coloradans

Quick Links

Building the Future

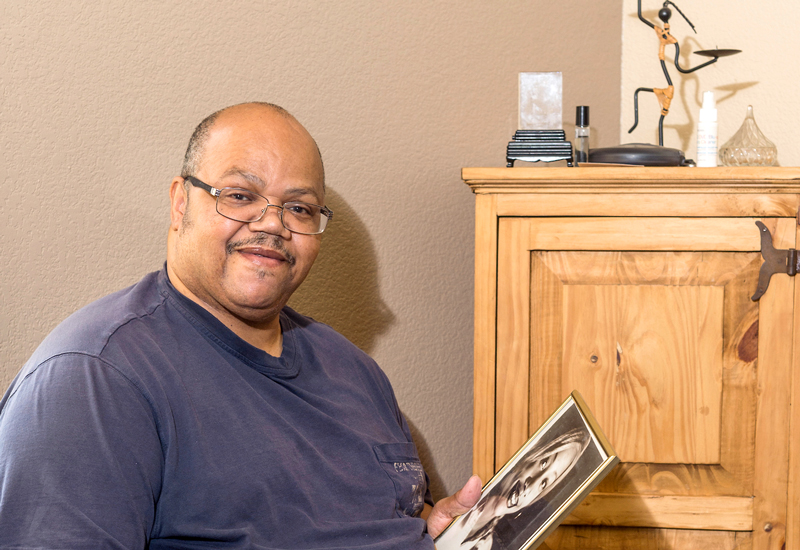

Watch the video to hear from Colorado affordable rental housing residents describe their communities and the passion they have for them.

CHFA Affordable Housing Development Cost Dashboard

This dashboard presents data on the costs of developing affordable housing supported with Housing Tax Credits in Colorado. Data is available from the last five years and can be explored by year, the five-year span, region, credit type, resident population, and development type.

Colorado Multifamily Affordable Housing Electrification Hub

The Colorado Multifamily Affordable Housing Electrification Hub is an interactive website that features technical resources, peer learning, and financing and development resources related to electrification design and decisions for affordable multifamily housing developments.

2024 Housing Tax Credit Scorecard

Contact Us

Denver - Main Office